I read somewhere that you should be losing half of your business on price, in other words you should set your price so that half of your potential customers won’t pay it.

Can this really be true?

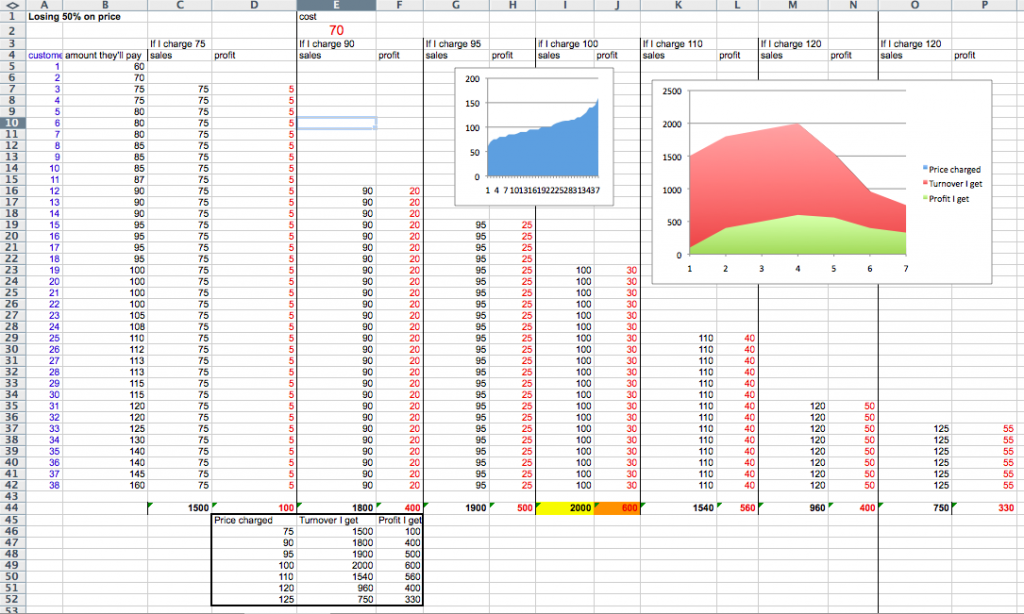

Well, I just made this spreadsheet simulation and sure enough, the rule is correct! if you set your price so low that pretty much every enquiry turns into an order then the price has to be so low that the profit margin on all this work is really low. You’d make more money doing less work but at a higher margin.

Of course, you have to have decent quality and customer care, and the elasticity of demand remains an unknown, but look at my sheet and the assumptions I’ve made and you’ll see it’s pretty sensible. And yet the result is indeed quite surprising – put your price up, and work smart rather than busy!

The spreadsheet explained:

I have listed 38 customers in column A, and in column B I have put the most that they’ll pay.

Customer 1 is such a cheapskate that he’ll only pay 60 so he’s not going to be able to afford us (or anyone decent) while customer 38 is a rich fool who’ll pay up to 160, so whatever price we charge we’ll get his business!

But in the middle are larger quantities of the more typical ones we’ll either win or lose depending on our price.

The question is: What should we charge in order to maximise profit?

The first price we’ll try is £75 (column C) – as you can see we only lose the first two customers – everyone else can afford our price, which is nice. We get 36 orders at £75 which is £1500 in total, and since our costs are 70 (I have made this number up – we’ll play with changing it later) we are making just £5 from each customer, so that’s a total profit of 100 (see column D).

This profit margin of 5 in 70 is about 7% and is probably what you’re making at the moment, so the example is quite realistic.

But as you’ll see, you’re not charging enough! You need to put up your price and lose some customers – about HALF of them in fact!

Let’s put the price up to 90. As you can see we now lose all the customers down to row 12, but we’re making 15 on each one, so overall we have a larger turnover (1800) – from fews customers! – and a much larger profit – at 400 it’s four times as much! Who cares that we’ve lost a quarter of our customers, this is MUCH better!

Let’s put the price up further, to 95, or even 100! Surely that’s too much?

Well we do indeed owe half of our customers now, but the extra price means we make more turnover and more profit – in fact this ’50% of customers lost’ is our point of maximum profit (See the red and green graph at the top which shows the 4th point as max profit and turnover).

Of course there is the question of elasticity of demand (the blue graph). Maybe you are in a market where a small increase in price would lose you all of your customers – but all I can say is “Test it and you might be surprised”. I’ve seen lots of examples where customers’ fears have not materialised. In a recent example a 15% increase led to a loss of only 2% of the customers.

Beyond 100 the loss in customers does indeed outweigh the increase in profitability and the figures are less favourable. Although 110 is interesting – you get almost as much profit, and quite a bit less work – for a one man band like me this could be worth doing!

Even at 120, where the customers and turnover have been decimated, the profit is still three times as much as the starting situation, where we are terrified of losing any business and therefore pricing ourselves far too low. Profit is sanity, turnover is vanity!

And by the way, on my spreadsheet I can change the 70 cost figure (in E2), but if I move it up or down significantly (from 40 to 80) it changes the total profits but it doesn’t change the point of maximum profit, which stays at 100, and when the cost goes above 80 it tells you to raise the price even more. For no cost value is it a good idea to charge only 75.

Conclusion:

a) are you charging enough??

b) can you produce one of these sheets for your business?

c) how about trying some experimental pricing?